Buy Now, Pay Later (BNPL)

MicroAnalytics analyzes the entire customer base and recommends low risk subscribers that are eligible for BNPL loans, enabling them to complete a purchase

Boost subscriber loyalty with expanded payment terms

Augment your buy-now-pay-later offers with sophisticated credit risk analysis, increasing conversion rates, reducing bad debt losses, and driving up consumer satisfaction.

Real-time eligibility

Subscriber requests for a BNPL loan through a carrier, a marketplace website or an app/e-wallet are evaluated and adjudicated in real-time, extending credit at the consumers moment of need.

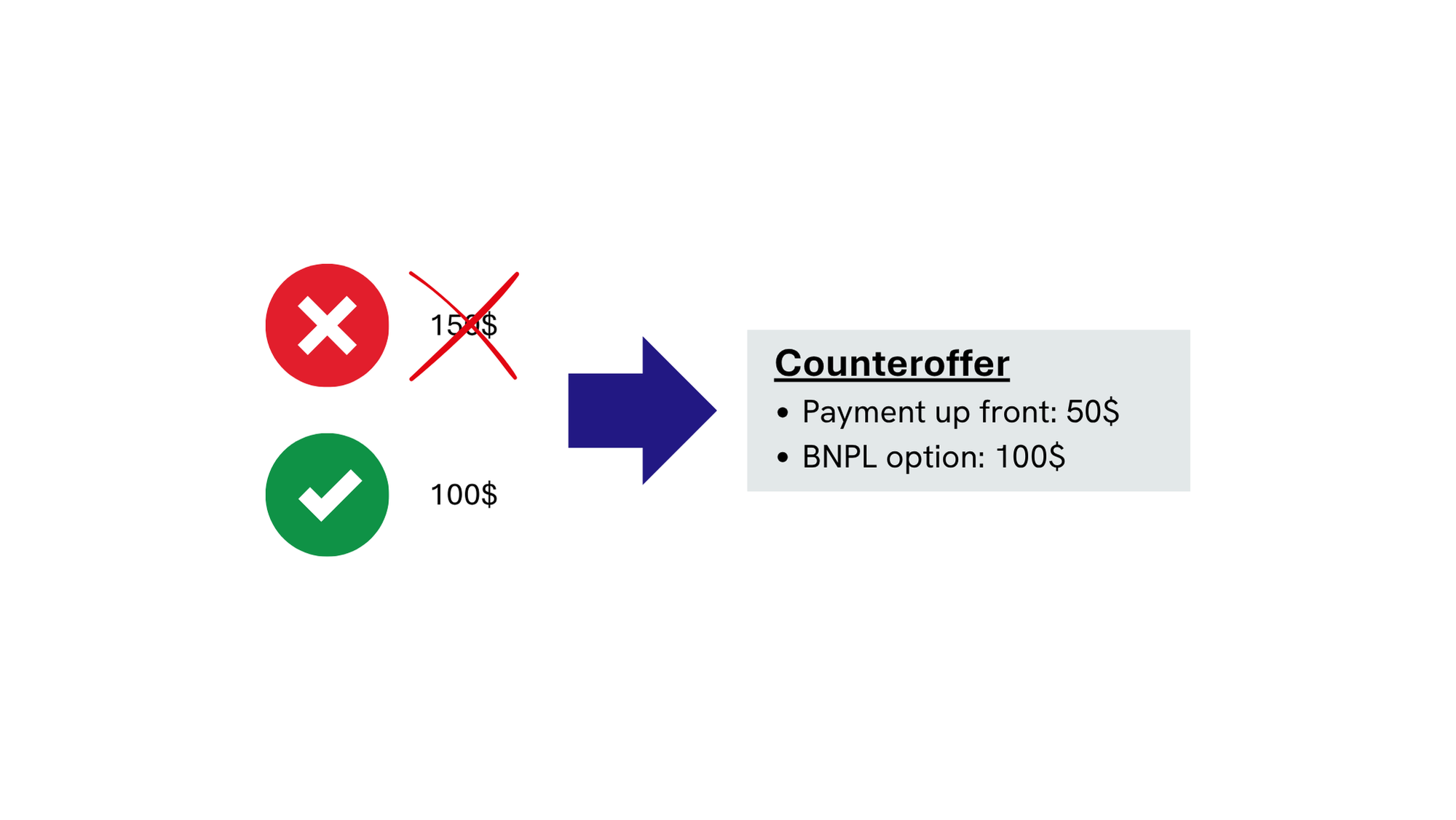

Counteroffers for risky borrowers

When a subscriber applies for a BNPL loan and their credit risk is deemed too high, MicroAnalytics will generate an alternative offer for the carrier.

This allows consumers to have the most chance to secure a BNPL loan while maintaining the credit risk exposure of the carrier and its lending partner.

Benefits

Boost conversion rates

For larger purchases, being able to secure a BNPL loan drives higher purchase volumes and happier subscribers.

Manageable credit risk

With MicroAnalytics’s advanced analytics technology, we score each user and structure offers that are tailored to their specific risk and opportunity. This ensures higher repayment rates for the BNPL lenders.

Improve loyalty

BNPL loans help subscribers break down payments into manageable installments, increasing consumer satisfaction, improving loyalty and reducing churn.